The Modern Gold Rush: How to Strike Gold with EV Charging Stations

One of the most overlooked issues when looking at the adoption of electric vehicles (EVs), and the growth of charging infrastructure, is the selection of charging station locations.

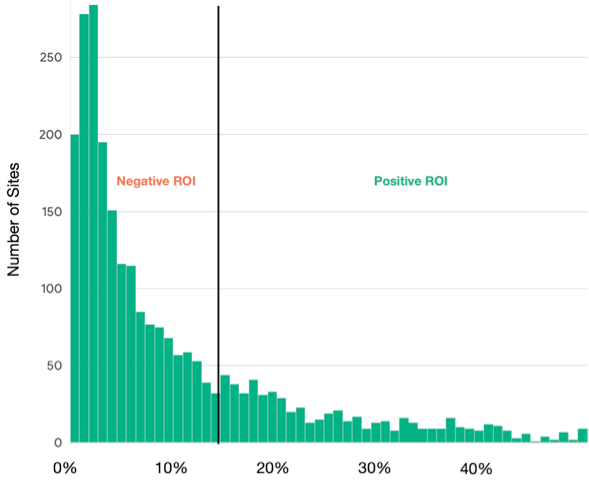

Around 70% of EV charging stations in today’s market are underutilized, according to EV charging utilization data from Stable Auto’s AI-driven platform.

The Success of the EV Charging Industry Hinges Upon Choosing the Right Locations

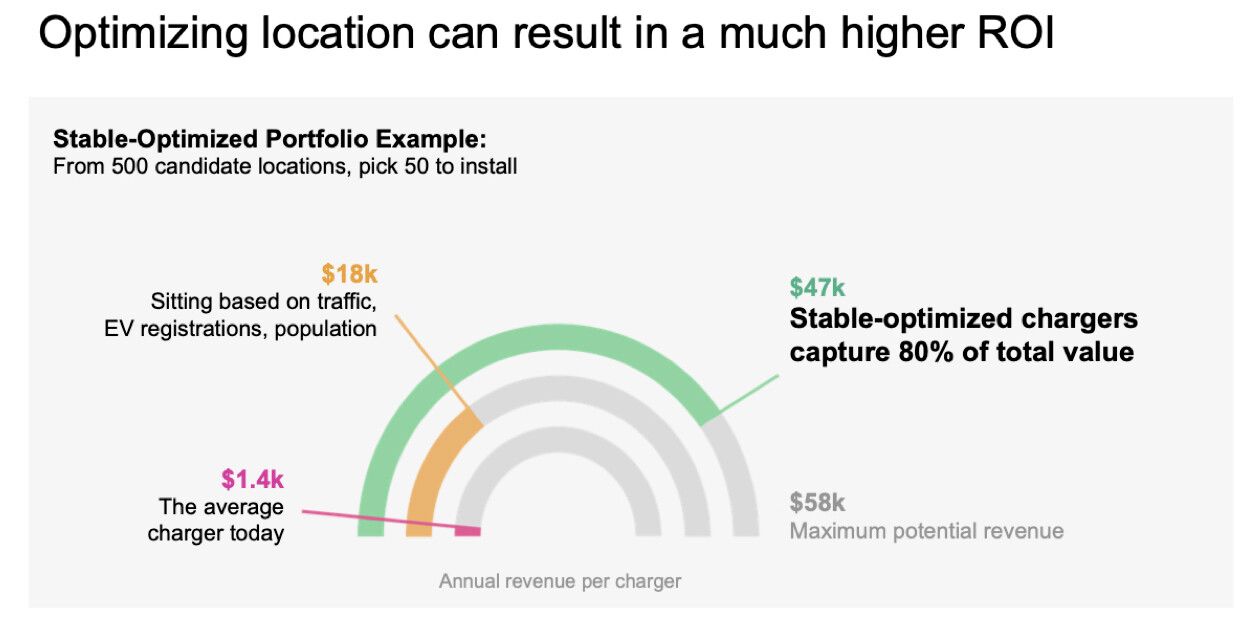

Deciding where to locate EV charging stations to maximize their use and profitability involves analyzing a number of factors, such as expected utilization or the cost of electricity. Because these variables are also continuously changing, the use of sophisticated machine learning helps unlock EV charging station optimization so that analysis and predictions can be done in a matter of minutes, versus taking an analyst team weeks or months to complete.

To reveal how to overcome the obstacles to scaling DC fast charging stations, Stable Auto recently led a webcast discussing the biggest challenges and opportunities for the EV charging industry, and how EV charging optimization solutions can help. Some ways that you can improve your DC fast charger deployment strategy and predict return on investment is by:

- Understanding your portfolio balance: It’s best to know early on which sites are likely to be poor performers and which will be good performers.

- Tapping into a large number of variables: Stable’s optimization platform analyzes over 75 variables per site that consider a charging site’s location, energy costs, traffic impact, EV penetration rates, and other factors. The fewer variables you analyze, the higher the risk of underperformance.

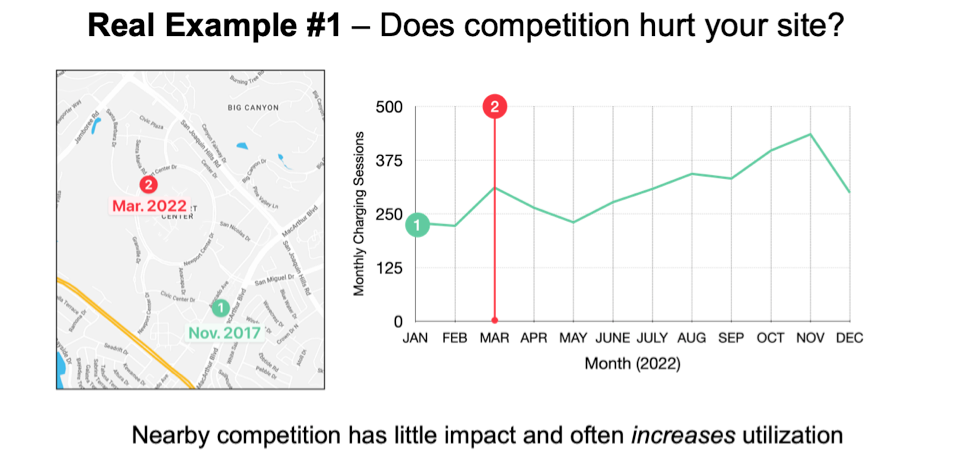

- Understanding the best charging sites are not always intuitive: It’s only when many data points are considered that charging stations can be profitable. For example, sometimes nearby competition can actually be a good thing.

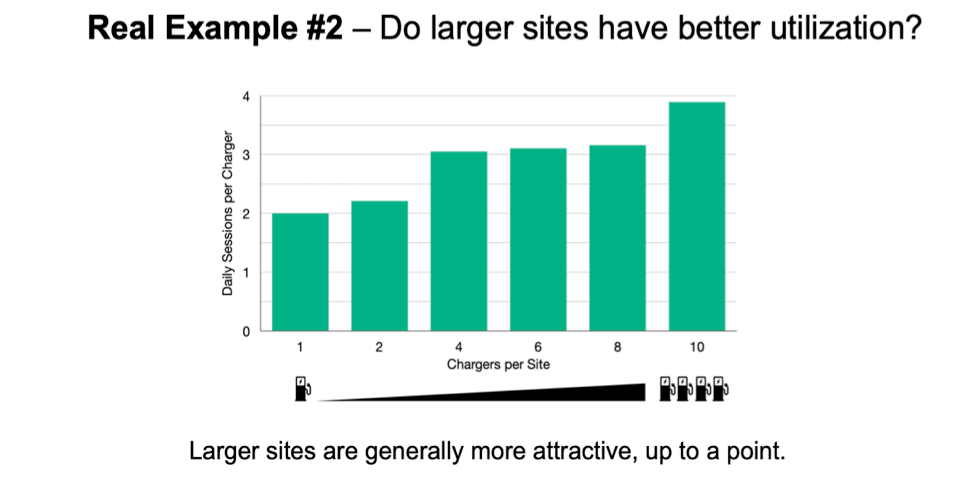

- Realizing the “if we build it they will come” approach isn’t a safe bet: Just because an EV charging station is built, doesn’t mean that it will be utilized enough to not lose money. Careful planning and analysis is critical for maximizing utilization and return on investment. For example, while larger sites are generally more future-proof and more attractive, that behavior only works to a point.

Reliable Charging is Critical for Widespread EV Adoption

As EV sales continue to rise as part of a modern gold rush, having reliable charging is absolutely critical for adoption. The number of EV sales this year has nearly tripled since 2011 and is expected to grow exponentially each year. The automotive industry has also doubled the number of electric vehicles and models just in the last year with California leading the way – accounting for 23% of the 2023 EV sales alone.

This growth is creating a greater need to increase the deployment of DC fast charging stations in markets from New York, to Colorado, to Washington and many other states in between. Experts predict that 2.4 million EV chargers are needed by 2030, but the U.S. is on pace to build only 430,000. To increase EV charging capacity, the National Renewable Energy Laboratory (NREL) estimates the U.S. needs to invest $44B in public fast charging by the end of the decade. As part of NEVI, roughly $65B needs to be invested to account for all of the growing needs Stable Auto customers already have.

Achieving Success Through Strategic Analysis

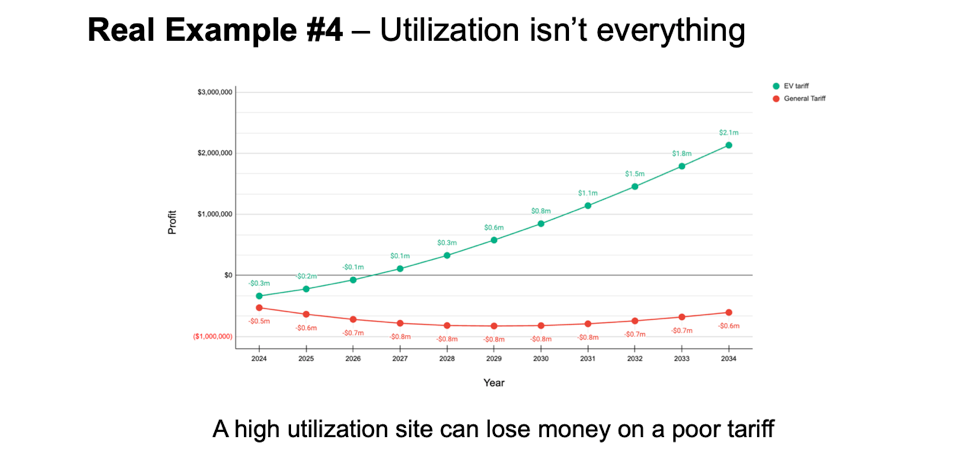

As more DC fast charging investments grow across the country, one size doesn’t fit all. Whether it’s accounting for NEVI-fueled policies and tariffs, geographic demographics, traffic, population, EV penetration rates, or energy costs, ROI can be optimized if research and data account for the best routes to profitability. One of the challenges in accounting for all of these variables simultaneously is the fact that many are dynamic in nature. Energy costs fluctuate throughout the day, incentives are constantly changing, and so is human behavior. What Stable has found, is that even sites with high utilization can lose money if there are poor tariffs.

Avoid Basing Your Deployment Strategy on Insufficient Analysis

Companies looking to invest millions of dollars in DC fast charging infrastructure should not rely on insufficient or manual analysis to find the best locations for their chargers, or the risk of underutilization is high. Instead, they need the right tools to make swift and informed decisions that will allow them to put EV chargers where cars and drivers need them most.

For more information about how Stable can help you make the right decisions when it comes to DC fast charger deployment, download a Stable Site Report to see what kind of projections Stable can generate.

Missed the webinar livestream? Watch the replay here!

Schedule a demo

Schedule a 30-min time-slot with us directly, or send us a message if there's something else we can help with.