Publicly available fast chargers — which can charge a standard EV battery 80% in 20-60 minutes — enable longer journeys, address range anxiety, and expand the market to consumers without at-home charging access.

Fast charging, like all EV charging, is controlled by provider networks, including ChargePoint, Electrify America, Supercharger (owned by Tesla), EVgo and a slew of others. There are three main types of DC fast-charging systems in North America: the Combined Charging System (CCS), the CHAdeMO, and Tesla’s North American Charging Standard (NACS).

Among DC fast charging networks, Tesla’s Supercharger is the largest network in the US, at roughly 20,000 chargers. To date, only Tesla drivers have been able to use Supercharger stations.

That’s about to change. In February 2023, Tesla announced that it would open up part of its US network to other EV manufacturers, in part due to pressure from the Biden Administration. In May 2023, Ford (the largest EV charging provider in North America, with its BlueOval Charging Network) was the first major automaker to announce an integration with the Supercharger network, offering its EV owners adapters to Tesla’s NACS connectors.

Following Ford’s announcement,GM,Nissan,Volvo,Mercedes Benz and Rivian all announced similar integrations. EV owners from these six OEMs will gain access to Tesla charging stations across the US as early as summer 2024. Over the next two years, these vehicle manufacturers will also integrate NACS connectors into new models, eliminating the need for adapters.

The default assumption was that these integrations would profoundly impact other charging networks.Using Stable Auto’s proprietary artificial intelligence (AI) model, our team projects that while the announcements represent a seismic shift for the industry, they may not significantly affect financial outcomes for competitor networks.

Competitive Impact of NACS Integrations

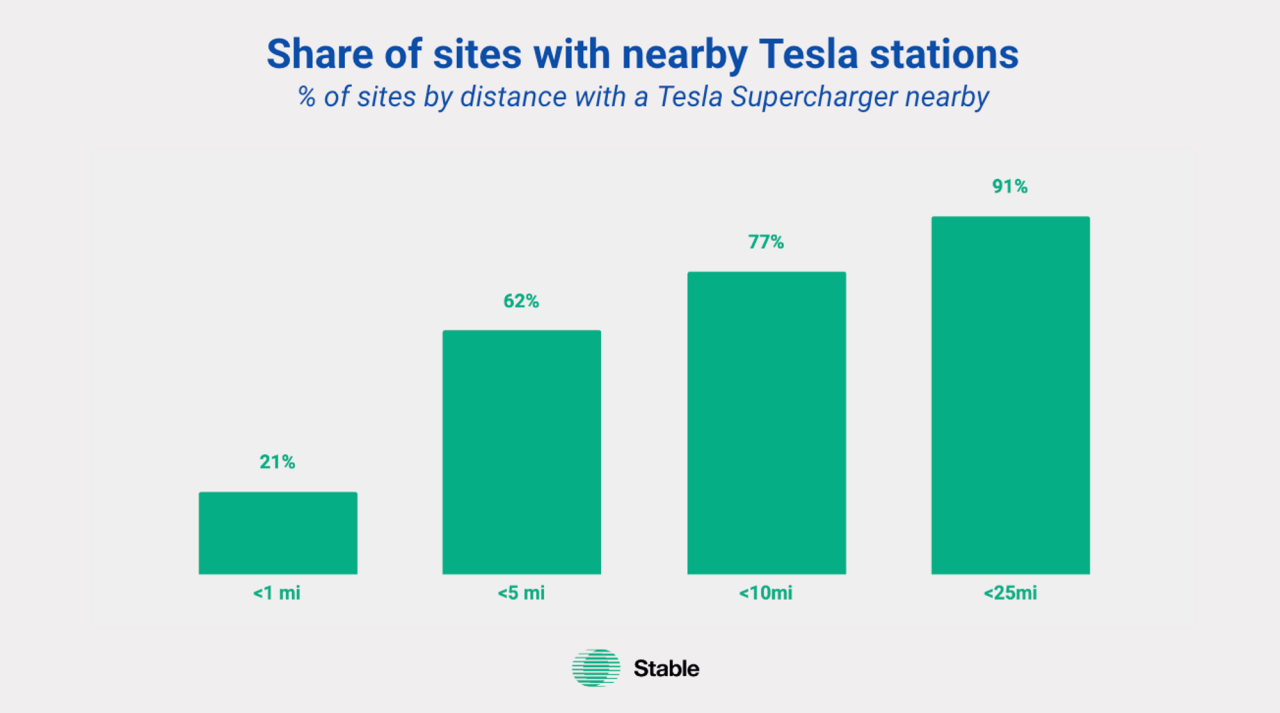

Let’s first consider the size of the impact. Of existing charging stations, 20% are within one mile of a Tesla Supercharger, 62% within five miles and 91% within 25 miles. A majority of stations should see some competitive impact from Tesla opening up its network, but only about 20% are directly competitive, according to Stable’s analysis.

For those stations within one mile of a Tesla Supercharger, we estimate that demand could decrease from as little as 3% to as much as 32% with a typical impact of 10-15%. For any one station, this demand loss could be material; but across a portfolio of charging locations, the impact on demand is likely to be less than 5%.

There are additional competitive dynamics to consider.

Charging demand ebbs and flows throughout the day, peaking between 3 p.m. and 9 p.m. (over 40% of charging takes place in this six-hour window). Today, the disparity between peak and off-peak demand means that even under-utilized stations can be overburdened during peak hours.

Because charging behavior is concentrated at peak times, in high demand areasTesla opening up their network could paradoxically increase demand at nearby stations.If Tesla stations are full, drivers are likely to look for nearby alternatives. If nearby stations are available, some of that demand is likely to get diverted towards them if Tesla is unable to keep up with their increased network demand.

Industry Tailwinds & Other Macro Dynamics

Similarly, Stable’s analysis points to a potential macro trend in which increasing EV charger availability generates increased demand for charging overall. As the industry well knows, the availability of charging stations (or lack thereof) is a major driver of EV adoption.

Barriers to EV adoption in the US

A rapid growth of EV adoption across the industry should more than offset individual competitive drag — even if that drag is greater than the 10-15% that Stable estimates.If the NACS integrations accelerate EV adoption even a small amount, it would more than offset any competitive drag faced by competing charging stations.

In July 2023, BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis announced that they’re joining together to create a network of 30,000 chargers across North America. The stations will be equipped with adapters for both the NACS and CCS connectors. The watchword for these seven OEMs — two of which joined the NACS network as well — is universal compatibility.<For more insights, read this Stable Auto blog:Automakers Are Building 30,000 New EV Chargers. AI Can Help Decide Where to Site Them.>

The DC fast charging industry is evolving in multiple ways.As EV charging access proliferates, informed decision-making around site selection can be even more critical. In this environment, Stable offers data-driven insights that predict utilization, compare and rank potential sites, and forecast revenue. Start analyzing demand and predicting the ROI for your next EV charging site today by scheduling a demo with our team.

Schedule a demo

Schedule a 30-min time-slot with us directly, or send us a message if there's something else we can help with.