The electric vehicle (EV) charging landscape is undergoing a significant transformation. Underutilized charging stations are decreasing, powered by increasing demand and data-driven insights. Despite news that the growth rate for EV adoption has slowed, overall adoption is still expected to rise annually, especially as lower cost vehicles continue to enter the market.

To ensure that charging stations are strategically placed and priced to meet the needs of potential EV drivers, Stable Auto analyzed data from tens of thousands of EV charging stations across the country that have been operational for more than four years. Here’s what our latest data revealed about charger utilization and pricing, and how they impact profitability.

State of EV Charger Utilization

Recent data has illuminated a rapid evolution of EV charging utilization across the United States, challenging misconceptions that EV charging is not a profitable business. Contrary to outdated beliefs, charger utilization rates have surged, particularly for L3 (DCFC), marking a remarkable 58% increase in the last 11 months, growing from an average of 11.4% in April 2023 to 18.1% in March 2024.

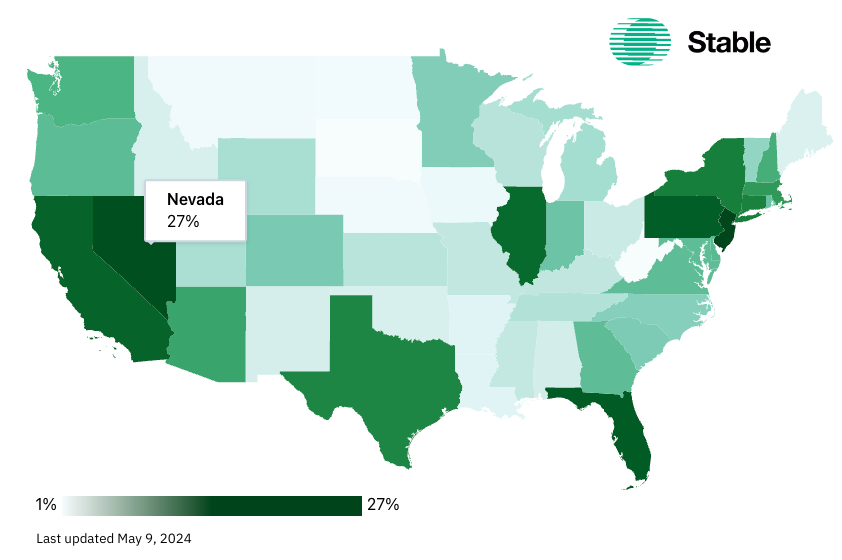

As highlighted by Bloomberg, a growing number of states are experiencing utilization rates well above the national average. Even with an average increase of 8% from 6.5% in April 2023 to 7% in March 2024, certain states like New Jersey emerged as leaders with utilization rates as high as 27.3%. With 15% utilization acting as the target for profitability, this staggering number is both impressive and promising.

On the other end, states like South Dakota that have low utilization rates of 0.4% did see a promising 144% increase since April 2023, highlighting the critical link between EV adoption and charger utilization. Wyoming also experienced the most significant increase in utilization, growing from 2.7% to 9.8%, a 256% increase.

Navigating Pricing Dynamics

In addition to achieving optimal utilization, another important aspect for EV charging station profitability is setting the right prices at the right times. According to Stable Auto’s insights on EV charging pricing trends, despite the correlation between high utilization and pricing, the landscape of EV charger prices reveals a nuanced reality.

States like California, with ambitious EV adoption goals and high utilization rates, paradoxically rank among the top 10 most expensive states for EV charging, averaging $0.51 per kWh. This discrepancy underscores the complexity of pricing EV chargers, as well as the need for innovative approaches to balance affordability with profitability.

Looking Ahead

As we venture into the second half of 2024, the demand for EV charging is expected to grow. Despite news that major players such as Tesla are pulling out of the EV charging market, significant opportunity remains. The US still needs thousands more DCFCs to keep up with projected demand, and with Tesla's uncertainty, even more expansion is needed.

As companies determine where to best build future chargers, the importance of data-driven placement and strategic pricing strategies cannot be overstated. Without data-backed solutions, expensive infrastructure is at risk of being underutilized—which not only impacts current EV drivers, but the future of clean transportation.

Schedule a demo

Schedule a 30-min time-slot with us directly, or send us a message if there's something else we can help with.