In most cases, peak usage and peak pricing go hand in hand: when stations are busiest, usually in the late afternoon and early evening, energy costs are usually at their highest. During quieter periods, prices drop to encourage drivers to plug in.

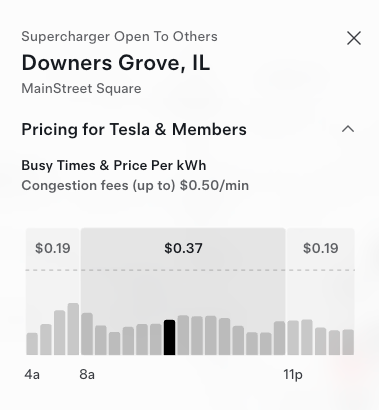

And yet, this isn’t always the case. At some stations, we see usage spike during off-peak hours. This Tesla Supercharger in Downers Grove, Illinois is a clear example. Look at the usage bars at 11:00pm. The moment the price drops to $0.19 per kWh, utilization jumps sharply. In fact, the highest usage occurs around 7:00am, not during the late afternoon or early evening when you would typically expect a station to be busiest.

We see this pattern regularly at sites we help manage. It’s especially common with high repeat users like rideshare drivers, but it can happen anywhere pricing is predictable and users are sensitive to cost.

A lot of the time, trading margin for volume can be an expensive proposition. Simply dropping prices across the board, even when discounts are dramatic, doesn’t drive the volume site hosts expect. You might cut your margin in half but only see a 10% increase in volume.

Sometimes though, it’s possible to have your cake and eat it too. By dropping prices at off-peak hours, you can gain volume from drivers who wouldn’t have shown up otherwise, without giving up margin during peak charging periods. In the strongest cases, this looks like a full station in the middle of the night rather than during traditional peak hours.

For operators, this phenomenon is easy to miss. It requires regular testing and a clear understanding of demand patterns in each market. Stable Operate tracks this automatically: it shows how demand shifts, how drivers respond to price signals, and where small pricing changes can lead to more revenue without hurting utilization.

To see how pricing and utilization interact at your own sites, get started for free with Operate’s Basic tier.

Schedule a demo

Schedule a 30-min time-slot with us directly, or send us a message if there's something else we can help with.