Editor’s note:

This article was originally published on LinkedIn by Rohan Puri, CEO and co-founder of Stable.

---

Utilization has historically been the gold standard metric for EV charging. 15% utilization became shorthand for profitability, and at Stable we’ve used that same benchmark across our marketing materials and website. There were already cracks in the foundation, since 15% utilization was always directional at best and really depended on the characteristics of each site. Now, we’ve gone from small cracks to giant splits. Utilization has gone from being a directional proxy for profitability to a metric that now needs much more context to be meaningful.

Three trends have coincided to put the final nail in the coffin:

- Vehicles are charging must faster than they used to

- Charging hardware has gotten both faster and more diverse

- Dual port chargers are capturing an increasing share of charging hardware

Utilization was never that helpful to begin with

As an industry we’ve been focused on utilization for a long time. Its appeal makes sense: it offers a simple shorthand metric that normalizes for station size and charging speed. It’s also easy to grasp intuitively—a charger that’s 30% utilized has a car plugged in 30% of the time. But it has always been a limited metric.

High energy costs or an expensive build out might mean 15% utilization is not enough to turn a profit. On the flipside, strong incentives or higher-than-average prices might mean turning a profit with much lower utilization. It’s also highly dependent on your cost of capital—what utilization you need will look dramatically different if you’re targeting a 10% return versus 20%.

Still, in a world where most chargers had similar speeds and installation costs, a 15% threshold was a decent proxy.

Vehicles are charging must faster these days

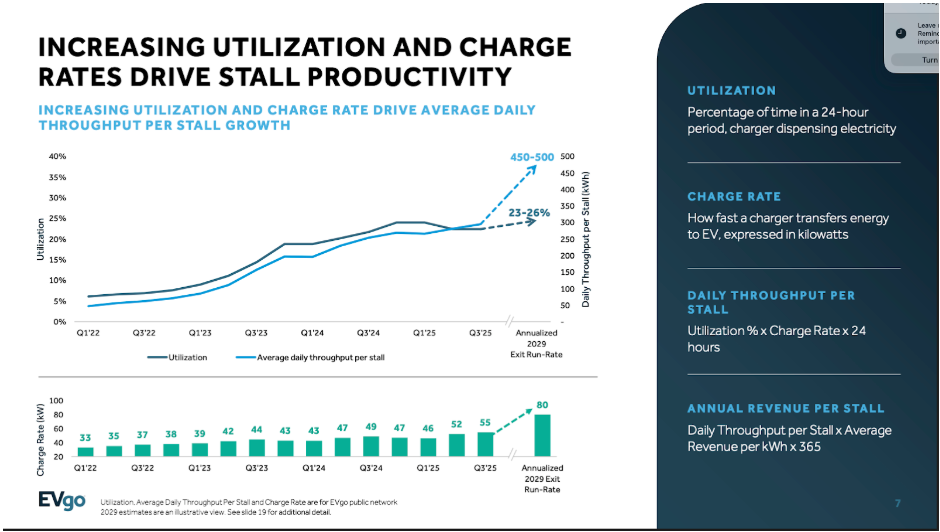

In the last few quarters, we’ve seen average charging speeds increase rapidly. In EVGo’s latest quarterly report, we see that their charger throughput (kWh / stall / day) has steadily increased to over 300 kWh / stall / day while utilization has decreased from a high of 24% in Q1 to 22% today. Over the past year, average session power on the EVGo network has increased 28%, from an average of 43 kW in Q1 of last year to 55 kW in Q3 of this year.

That means a charger that’s utilized 12% of the time today is dispensing as much power as one that was utilized 15% of the time just a year ago.

There used to be a time when a 50kW charger was considered fast. Now, the state of the art is a 1MW charger, and 350kW+ chargers are increasingly the norm. Faster chargers are shifting the math on utilization. And it’s not just the chargers that are getting faster.

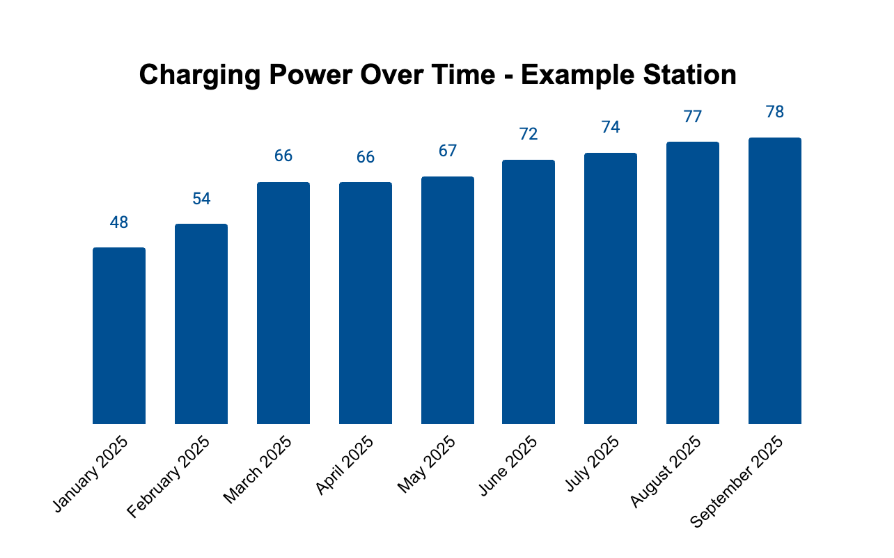

Even within the same station, we’ve seen average charging speeds rapidly increase. Here’s an example from one of the stations Stable helps manage, where the average charging speed increased more than 60% over the first nine months of the year.

We’re seeing a new generation of vehicles that can not only charge at peak speeds of >200kW but also sustain charging rates over 100kW for most of the charging curve.

All of that changes utilization math substantially. Whereas 15% was once a reasonable target, in this new world, you might break even at just 10% and be extremely profitable at 20%.

Charging hardware has gotten much more diverse

It’s not just that charging speeds have increased, we’re also seeing a much greater diversity in the types of charging hardware CPOs are deploying. Depending on the use case, a CPO might deploy 62.5kW, 150kW, or 300kW+ chargers. It’s also not atypical to see a mix. The economics on those chargers can look very different depending on the mix of vehicles served. 15% utilization on the 62.5kW charger could easily mean half as many electrons vs. a similarly utilized 350kW charger.

There are also meaningful differences in the hardware costs between the two, and demand chargers are also an important consideration. Whichever way you cut it, utilization alone is no longer a reliable way to compare performance.

The rise of dual-port chargers

The final nail in utilization’s coffin is the rise of dual-port chargers. More CPOs are opting for chargers that can serve multiple vehicles at once, creating both installation cost advantages and improving efficiency through better dynamic power management.

But the utilization math on dual-port chargers is dramatically different. Each charger can now be plugged in for twice as many hours. While the hardware is more expensive, it’s typically less than the cost of installing two standalone units. Between lower installation costs, different utilization denominators, and efficiencies like power sharing, a dual-port charger where each port is utilized just 8% of the time might be as profitable as a single-port charger with double the utilization.

What comes after utilization?

If utilization is no longer the best way to compare profitability across chargers, then what’s more helpful? At the end of the day, the most useful metric is profit per station and profit per stall. That’s ultimately what matters, and while it’s much harder to calculate, it’s exactly what we measure in Stable’s Operate platform.

Profit as a metric adjusts for charger power, energy costs, lease terms, and other factors that might meaningful differentiate the profitability of two chargers with similar utilization. Looking at stalls instead of chargers increasingly makes sense because the number of boxes you have at a charging station matters far less than how many cars can ultimately plug in.

Beyond profit, it’s also helpful to talk about kWh, revenue, and sessions at stations and per stall. All three metrics give a better sense of how much energy a charger is actually delivering and how much revenue it's generating. And yes, sometimes…

Utilization isn't the best proxy for profitability anymore, but it’s still useful

And yet, utilization still has its place. While it’s no longer the best metric for measuring charger profitability, it remains a useful way to understand station crowding. A DCFC that’s plugged in 30% of the time might struggle to absorb additional demand unless that station owner finds a way to spread usage into off-peak hours. A charger operating at 50% utilization might be at its limit, with little potential for additional usage.

Utilization continues to be an incredibly useful metric when managing a network, it’s just no longer the best one for comparing profitability across stations.

If you want to explore the data behind this trend, our updated utilization and pricing index is available here.

Schedule a demo

Schedule a 30-min time-slot with us directly, or send us a message if there's something else we can help with.