Seven major auto manufacturers – BMW Group, General Motors, Honda, Hyundai Motor Company, KIA, Mercedes-Benz AG, and Stellantis –announced that they will invest at least $1 billion to double the number of DC fast chargers across the United States and Canada. The first chargers will go into operation in mid-2024, with all new chargers planned to be in place by 2030. Now, the industry challenge will lie in placing the 30,000 new chargers in locations that maximize both customer benefit and long-term viability.

At Stable Auto, EV charger performance data tells us that utilization factors are nuanced and hyper-local. Optimizing DC fast charging (DCFC) placements across North America will require fine-grained, site-specific analysis. Everything from nearby amenities to price per kWh can drastically change the performance of a public EV charging site, while EV sales trends, charger competition, and vehicle charging times are among the many factors that will impact how usage changes over time.

As these auto manufacturers plan the public DCFC infrastructure that will serve as the foundation for EV use ten years from now, it will be vital to forecast the future usage patterns of EV drivers. Here are a few of the key factors companies should be considering as they decide where to deploy these 30,000 new chargers:

Cost efficiency of EV charging infrastructure

Building the ideal EV infrastructure will require a careful examination of the cost dynamics unique to each potential site: local energy cost, utility tariffs, state-specific rebates and programs, and more. Those cost factors, paired with projected utilization, will determine which placements can maximize ROI. For example, factoring in the right rate tariff – and projecting how rate tariffs should be upgraded as site energy load increases – can have a critical impact on ROI.

Deploying public DCFC for drivers without at-home charging

Public chargers aren’t just for EV drivers on road trips. Many potential EV drivers – particularly those living in multi-family housing and/or low-income communities – don’t have access to home charging. An equitable EV infrastructure requires sites that Cory Bullis at Flo describes as “home-adjacent” – conveniently located to become a regular charging location for EV owners without home charging. That means considering placements in neighborhoods as well as in commercial centers.

Site amenities vs. charging speed

Site success isn’t only about charging speed. Our data shows us that EV drivers are spending slightly longer at DC chargers despite faster charging speeds – it’s worth spending a bit more time to get a full charge, especially when there are appealing amenities available. At some sites, it will make sense to prioritize the number of charge ports over peak charge power. As auto manufacturers invest in new sites, matching the nearby amenities with the appropriate number of ports can be just as important as charger speed.

Planning EV infrastructure for tomorrow's growth patterns

The charging sites built today should be developed with the user base of the future in mind. A site that seems ideal now might not be optimal five years from now – and vice versa. Stable Auto’s data analysis has found that the sites that promise the highest growth are in areas that currently have lower EV ownership – over time, sites that are less obvious picks today will see a greater increase in demand. The developers who invest in these locations today could reap the benefits of first-mover advantage.

Site choice through broad geographic and demographic classifications will miss opportunities to break ground in these high-potential areas. Finding future-proof sites will require nuanced site-by-site analysis that forecasts changing energy costs, competition among vehicle manufacturers, vehicle purchasing trends, and more.

Exploring the possibilities with site reports and projections

According to IEA’s 2023Global Electric Vehicle Outlook report, EV sales are expected to grow by another 35% this year to reach 14 million cars. Now, our job is to channel this energy into strategic, thoughtful charging infrastructure.Imagine the potential of a billion-dollar investment directed towards quality over quantity – to smart and efficient deployments, not just sheer volume.

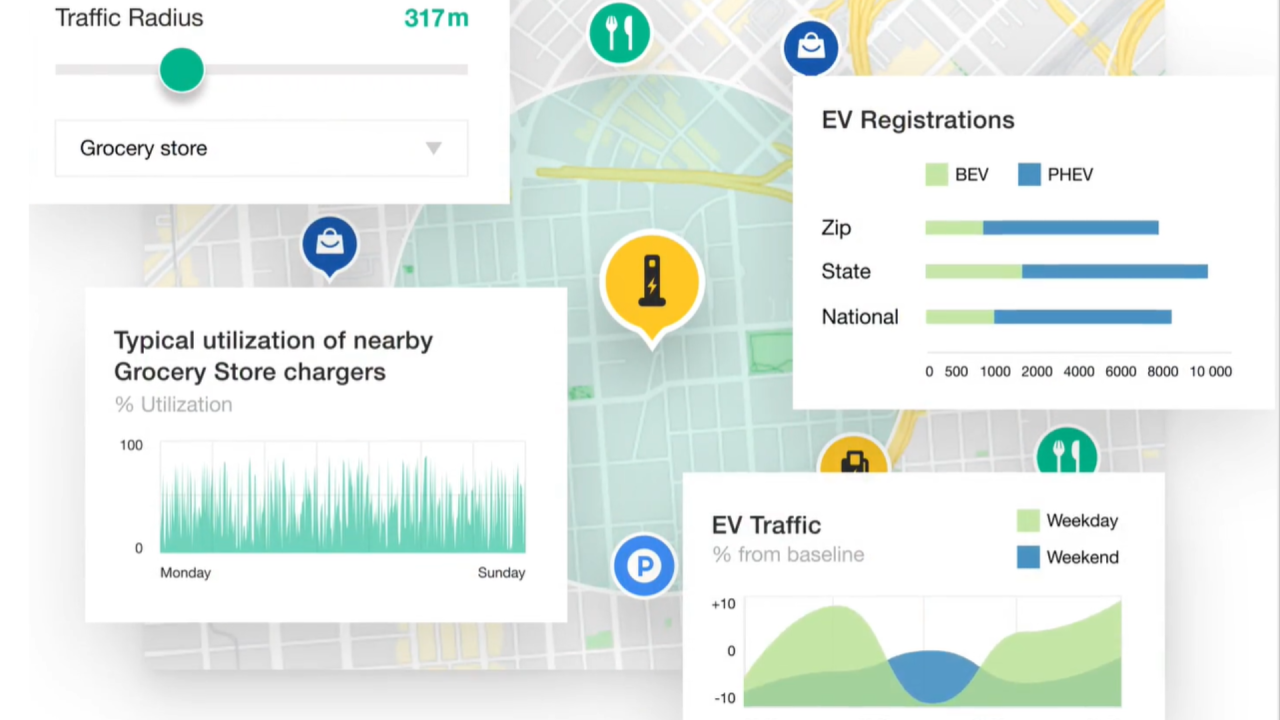

That’s exactly whatStable Auto’s platform is built for. Our reports correlate over 75 critical factors with real utilization data from public chargers across the U.S. to predict demand and ROI at new public DC charging sites.

For an example of how our machine learning platform works, we’ve created a sample report that shows an analysis of a site in San Diego, including projected site utilization, charging cashflow, and more. Download our sample report here to get started.

Schedule a demo

Schedule a 30-min time-slot with us directly, or send us a message if there's something else we can help with.